Please note our FAQs are regularly updated in accordance with published guidance and substantial changes to the CJRS.

On 20 March 2020, Chancellor Rishi Sunak announced an unprecedented package of measures, including a Coronavirus Job Retention Scheme (CJRS). This note summarises the grant which is available to all UK employers and is based on detailed guidance from HMRC and the Treasury that was published since March.

The furlough scheme has been extended a number of times since March 2020. As of 25 January the furlough scheme is currently set to end on 31 April 2021.

Employers should always consult the current government guidance on furlough before making decisions.

Eligibility: UK employees who (1) are paid by a UK employer, (2) who were on the payroll as of 19 March 2020* (3) have a HMRC online RTI PAYE record submitted for them on or before 19 March 2020*, (4) have been asked to stop working but who remain in employment for either all or, from 1 July 2020, part of their normal working time; and (5) (from 1 December 2020) who are not serving a contractual or statutory notice period.

*30 October 2020 for employees furloughed for the first time on or after 1 November 2020

See Q12 below for special rules for employees who left employment and have been reinstated, including those who were on payroll as of the previous eligibility date of 28 February 2020, but left after then.

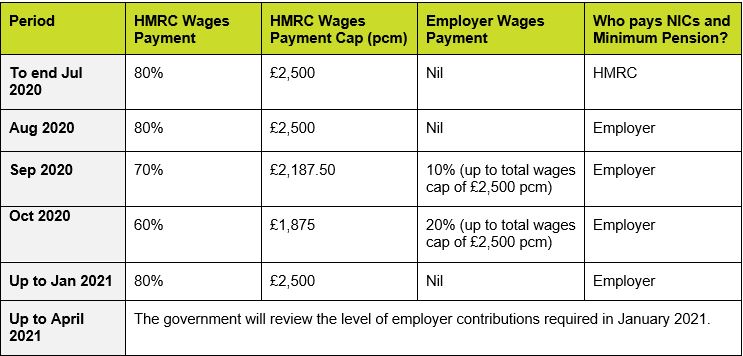

Amount: HMRC will reimburse (1) 80% of wages up to £2,500 per month; plus (2) associated employers’ national insurance and minimum automatic enrolment employer pension contributions. This means that the grant maxes out for employees with a base salary of £37,500. The level of reimbursement will be reviewed at the end of January 2021. These amounts have changed throughout the scheme’s history (see Q3 below).

Period: The furlough scheme is expected to last until the end of April 2021.

Process: To claim the grant employers will need to:

- notify employees in writing that they have been furloughed and they should not work and obtain the employees’ written agreement to that;

- from 1 July 2020, reach written agreement with employees regarding any move to flexible furlough;

- pay employees as per the usual payroll practices; and

- submit information to HMRC through a new portal

Top up: Employers do not have to top up payments to 100% of wages to qualify for the grant.

Documentation: To qualify for the scheme, there must be “written agreement” between the employer and the employee for the employee to be furloughed.

From 1 July 2020, if an employee is being flexibly furloughed, a further “written agreement” is needed. There are new record-keeping requirements for employees placed on flexible furlough (see below, Q31).

What constitutes “written agreement” for the purposes of the scheme, is broader than one might ordinarily expect (see Q30 below).

We set out on the following pages answers to some frequently asked questions. We highlight questions as *UPDATED* where the answers have substantively changed since our last FAQs.

Frequently Asked Questions (Updated 26 January 2021)

Q1: *UPDATED* Can an employee work for the employer who has furloughed them during furlough?

The position differs for those who are fully furloughed and those on flexible furlough.

Fully furloughed

No, with very limited exceptions. Employees could not do any work that made money for your organisation or provided services for your organisation (or for any linked organisation).

A furloughed employee could take part in volunteer work or an approved form of study or training (see below) for their work. Employee representatives (union or non-union) could also undertake duties in relation to a collective consultation exercise if relevant.

An approved form of study or training is any study or training intended to improve the employee’s effectiveness in the business, or the performance of the business, and which did not:

- provide a service to the business;

- contribute to the employer’s business activities or to anything generating income or profit for the employer; or

- directly contribute to any significant degree to the production of any goods or to any service that the employer will provide to clients or customers.

If workers were required to complete online training courses whilst they are furloughed, then they must have been paid at least the minimum wage for the time spent training, even if this was more than the 80% of their wage that will be subsidised.

Although the guidance did not expressly deal with it, we do not see any likely issue with an employee logging-on to check HR emails or attending calls with HR by way of “keeping in touch” with the business whilst they were on furlough – but employees should not have been performing any substantive work. Similarly, there should have be no objection to an employee having taken the occasional short call from colleagues to ensure continuity of work being undertaken by others.

Flexible furlough

From 1 July 2020 employers have been able to bring back furloughed employees to work part-time.

Employers have considerable flexibility to decide how to structure flexible furlough. Employers are still able to “fully” furlough employees – i.e. where the employee does not work for the employer, as set out above – subject to the eligibility criteria being met.

During periods where the flexibly furloughed employee is working, they are able to work as normal. During time where they are furloughed, they are subject to the usual restrictions set out above and cannot do any work for the employer.

Employers will need to calculate the “usual hours” for employees on flexible furlough (see Q5 below) as well as the amounts that must be paid to the employee and which can be reclaimed from the Government (see Q3 and Q4 below). Flexible furlough imposes new record keeping requirements on employers to keep records of hours worked and hours spent on furlough in each period claimed for (see Q31 below).

Q2: Can an employee work for another employer during furlough, or get a new job?

Yes, provided the other employer is not related to the furloughed employer. If the employee gets a new job, the employee can start work for the new employer (again, provided the new employer is unrelated to the “furlough” employer).

This rule also applies to those on flexible furlough, meaning that such employees will be able to work for another employer in the time they are furloughed (even if they are working part time for their original employer).

Q3: *UPDATED* What amounts can an employer claim?

This is changing and depends on what furlough period is being claimed for.

Q4: *UPDATED* How is the monthly wage calculated?

Employers will need to take a different approach for employees who are on full time furlough and those who are flexibly furloughed. Different calculations are needed depending on whether the employee in question in question is considered to be paid a fixed rate (i.e. a typical salaried employee whose pay does not vary by hours worked) and those whose pay varies (such as employees paid for hours actually worked. The reference dates used in these calculations will also vary depending on when the employee was first furloughed.

There is now dedicated guidance on how to calculate the monthly wage of a furloughed employee, including a calculation tool – see here.

If the employee is fully furloughed

For salaried employees (full-time or part-time), the government’s employer guidance is that the monthly wage is calculated by reference to the employee’s “salary” for the last pay period prior to 19 March 2020 or 30 October 2020 (or employees who were furloughed for the first time from 1 November 2020) and the payments addressed in Q6 below.

For salaried employees who are returning from a period of statutory absence (such as family-related leave) and are furloughed, the general principle is that you use their salary, before tax, and not the pay they received whilst on statutory absence. Although the guidance does not provide a specific date against which to measure salary, presumably it would be the employee’s salary as at the date they returned.

If a salaried employee has worked a substantial amount of paid overtime in the relevant pay period (or in the tax year including that pay period), the employer may need to use the calculation method for employees with variable pay (see below). No guidance is provided for what will be considered substantial overtime. We expect that it will be only in exceptional circumstances that an employee will fall into this special category, but employers should consider the calculation used carefully where employees have worked significant amounts of paid overtime.

For employees with variable incomes, including “zero-hour” employees, the position is more complicated. For employees with variable incomes who had been employed for a full year prior to 19 March 2020, employers will be able to claim the higher of either:

- the amount the employee earned in the corresponding month to the period being claimed for in the 2019-20 tax year; and

- an average of their monthly earnings for the 2019-20 tax year.

For employees with variable incomes who had been employed for less than a year prior to 19 March 2020, employers should calculate the average of the employee’s regular monthly wages from the date they started work (or 6 April 2019, if later) until they were placed on furlough.

For employees who were employed after 19 March 2020 and placed on furlough on or after 1 November employers should calculate 80% of the average wages payable between 6 April 2020 (or the date employment began, if later) and the day before the employee was furloughed.

If employee is flexibly fruloughed

Calculating how much can be recovered from the UK government where an employee is flexibility furloughed is complex and requires employers to calculate the following:

- the employee’s usual hours (see below, Q5);

- the employee’s monthly wage, as set out above;

- the number of hours worked and on furlough in the claim period;

- the wage costs in respect of furlough hours recoverable under the CJRS.

The amount that can be recovered under the CJRS is the lesser of 80% of the employee’s usual wages (subject to the tapering from 1 September, see above Q3) or the maximum monthly amount for the relevant month (see above Q3), multiplied by the number of hours spent on furlough in the claim period, divided by the number of hours spent working in the claim period.

Q5: *UPDATED* How do we calculate a flexibly furloughed employees “usual hours”?

The calculation needed will vary depending on whether (i) the employee has fixed contractual hours and their pay does not vary based on the hours worked and (ii) the employee works variable hours. Detailed government guidance is available here and some worked examples are available here.

Calculation for those flexibly furloughed prior to 1 November 2020

If the employee works fixed hours their “usual hours” in the claim period are calculated by reference to their contractual hours as at the end of their reference pay period (i.e. their last pay period ending on or before 19 March 2020 or 30 October 2020 – see Q4 above). A detailed description of the calculation is available here.

If the employee works variable hours and was first placed on furlough on or before 31 October 2020 their “usual hours” are calculated based on the higher of:

- the average number of hours worked in the tax year 2019 to 2020 up until the day before they were furloughed, or the end of the tax year if earlier; and

- the hours worked in the corresponding calendar period in the tax year 2019 to 2020.

This should include any hours of paid leave in the period where the employee received full pay (such as annual leave) and any overtime hours where pay was not discretionary.

For employees first furloughed on or after 1 November 2020, usual hours are calculated by finding the average number of hours worked from 6 April 2020 (or the employee’s first day of employment, if later) until the employee was furloughed.

You must then calculate the usual hours for the specific pay period (or partial pay period) you are claiming for. The calculation used will vary depending on whether you are using the average number of hours in 2019/20 or the hours in the corresponding pay period. A detailed description of the calculation to follow is available here.

Q6: What payments to employees does their monthly wage cover?

As referred to above, there is now dedicated guidance on how to calculate the monthly wage of a furloughed employee, including a calculation tool – see here.

An employer can claim for any “regular” payments it is obliged to pay its employees. This includes wages, past overtime, compulsory fees and compulsory commission payments. However, any discretionary bonus (including tips) and commission payments, any “irregular” or conditional payments, and any non-cash payments or benefits-in-kind should be excluded.

Q7: What about pension and other benefits?

Employers have a statutory obligation to automatically enrol employees in a workplace pension and there are no powers in place to vary that obligation. Employers will continue to have to make these payments.

Up to the end of July 2020, the scheme covers the minimum pension contribution under UK auto-enrolment rules. In other words, this will be 3% of the employee’s qualifying earnings based on their furlough payment of up to £2,500 per calendar month.

The scheme rules state that any pension payment to a business must be paid into the employee’s pension account in full (i.e. without any deductions at all). The UK Pensions Regulator has also issued new guidance on auto-enrolment compliance during furlough (see here).

From 1 August 2020 employers will need to make pension contributions themselves. This will not be covered by the scheme for reimbursement (see Q3 above).

Employees continue to be entitled to all their other benefit rights under their employment contracts unless they are varied – so employees will be entitled to bonus, commission, healthcare etc.

Varying these rights may or may not require consent depending on the terms of the employment contract. Employees who are furloughed may agree to forgo these benefits.

Q8: *UPDATED* What about holiday accrual, taking holidays and holiday pay?

There are various related questions here. Below, we set out the current position as we best understand it, however ultimately the relationship between furlough (which is governed by the Treasury/HMRC scheme rules) and holiday entitlement (which is governed by the Working Time Regulations 1999) would need to be dealt with by the courts/tribunals (i.e., it is not just a matter for HMRC to provide guidance on). On 13 May 2020 the Government issued some guidelines on taking holiday during furlough, which are separate from the CJRS rules. These guidelines are likely to be followed by everyone, though they do not have the force of law.

- Does holiday continue to accrue during furlough? The general view, which we agree with, is that the answer is yes for statutory holiday entitlement accrual. It will also normally be yes for extra holiday entitlement provided by employers (i.e., in excess of the statutory minimum), unless the employee’s furlough agreement/letter specifically says something to the contrary. This will continue to be the case where an employee is flexibly furloughed, subject to any agreement between the parties to the contrary.

- Is an employee allowed to take a holiday during furlough or is this legally prohibited? Yes (and this is the current view of the government).

- Can an employer force an employee to take holiday during furlough? Ordinarily, the Working Time Regulations do allow an employer to require an employee to take their holiday on specific dates by notice. There is no clear legal answer yet to whether this rule also applies during furlough, but we think it probably does and the Government has published guidance expressing its view that an employer can still require an employee to take holiday during furlough (provided it is reasonably practicable for the employee to do so – see below, in relation to the new carry-over rules).

- Does taking a holiday break the required continuous period of furlough to claim under the scheme (meaning the employer cannot claim for reimbursement under the scheme)? No.

- What about holiday pay? This also remains unclear. Our view (also that of the Government and ACAS) is that if a salaried employee takes a holiday then they are entitled to be paid at their “normal” rate (i.e., their pre-furlough pay) unless they have agreed to a permanent reduction in their normal salary (not just a temporary reduction during the furlough period). This, in particular, may be something the courts need to look at because it involves interpreting the Working Time Regulations. For employees who are not salaried but have variable pay, the position is more complicated – please speak to your employment law adviser to discuss this further. The Government also says that this rule applies to bank holidays that an employee would normally take as a holiday day (i.e. to be paid at the employee’s “normal” rate), but not bank holidays the employee would normally be working (which can remain at the “furlough” rate).

- What are the new rules on carry-over? The Working Time Regulations have been amended so that employees can carry over up to 4 weeks holiday to the next and subsequent holiday years where it was not “reasonably practicable” for the employee to take their holiday accrual “as a result of the effects of the coronavirus (including on the worker, the employer or the wider economy or society)”. Interestingly, the government issued guidance on 13 May 2020 which included its view that it would not be “reasonably practicable” for an employee to take a holiday if the employer could not afford to pay the employee their normal holiday pay entitlement for the day(s) off.

Q9: What about employment rights?

Employees will continue to accrue continuous service whilst on furlough. This means that some employees who do not yet have the two years’ service required to claim a statutory redundancy payment and to bring an unfair dismissal claim may acquire these rights whilst on furlough.

Q10: What about tax, national insurance and other deductions?

Payments made by the employer will be subject to the usual deductions for income tax and national insurance.

Up to 31 July 2020 employers were able to reclaim the employer’s national insurance (subject to the financial limits discussed above). After 1 August 2020, employers need to bear the cost of employer’s national insurance deductions themselves.

Pension is dealt with separately (see Q7 above).

Payments are also subject to other deductions such as Student Loan repayments.

Q11: Do we have to pay employees for whom we do not have work at the moment?

Yes, whilst employers probably have the right to send employees home and/or to not require performance in these exceptional times, employees have the right to be paid provided that they are ready, willing and able to work.

The only exception would be if the employment contract expressly permitted lay off without pay or if the employee agreed to any pay reduction as part of a furlough arrangement.

Q12: What payroll dates apply? What is the position of employees who have already been made redundant or otherwise stopped working?

Under the furlough extension from 1 November 2020

Employees will be eligible under the extended furlough scheme if they were on PAYE payroll on 30 October 2020. Being on payroll for these purposes means that the employer had made an online PAYE RTI submission notifying payment for that employee between 20 March and 30 October 2020.

Employees who stopped working for their employer – including those who were on fixed-term contracts – can be re-hired and placed on furlough provided they were (i) on the PAYE payroll on 23 September and (ii) a PAYE RTI submission notifying payment for that employee was made between 20 March and 30 October 2020.

Under the historic furlough scheme up to 31 October 2020

Eligibility

The general rule now seems to be that an employer can claim for any employee (including a fixed-term employee) who was “on your payroll” as at 19 March 2020.

“On your payroll” for these purposes means that the employer had made a HMRC online RTI PAYE submission notifying payment for that employee on or before the relevant date (19 March 2020).

Special rules apply to employees who stopped working before 19 March 2020, provided they were “on your payroll” as of 28 February 2020.

Employees who first started working for an employer after 28 February 2020 and who stopped working for that employer before 19 March 2020, appear not to be covered (however, this is complicated so please discuss it further with your adviser in the unlikely case that this applies to your business).

Employees who stopped working

The rules are now as follows:

- An employee who was “on your payroll” as of 28 February 2020 and who stopped working after that date, can be reinstated and placed on furlough even if the reinstatement occurs after 19 March 2020.

- An employee who was “on your payroll” as of 19 March 2020 and who stopped working after that date, can be reinstated and placed on furlough (again even if the reinstatement occurs after 19 March 2020).

Fixed-term employees

HMRC is now saying that a fixed-term employee whose contract has expired can be re-employed and placed on furlough if:

- their contract expired after 28 February 2020 and they were “on your payroll” on or before 28 February 2020; or

- their contract expired after 19 March 2020 and they were “on your payroll” on or before 19 March 2020.

The guidance says that fixed-term employees who started and ended the same contract between 28 February 2020 and 19 March 2020 will not qualify for the scheme.

Employees with serial employers

The rule here is straightforward, and we reproduce it in full:

“If an employee has had multiple employers over the past year, has only worked for one of them at any one time, and is being furloughed by their current employer, their former employer/s should not re-employ them, put them on furlough and claim for their wages through the scheme.”

Q13: What is the position of employees with whom we have already agreed reduced hours or reduced salaries?

Under the historic furlough scheme prior to 1 November:

Up to 30 June 2020, the guidance states that employees who remain working but with reduced hours/pay, will not be eligible for the scheme. There would seem to be no objection to placing those employees on flexible furlough from 1 July 2020, subject to the eligibility requirements – in particular the employee must have completed a qualifying 3-week period of furlough as of 30 June (meaning they were first placed on furlough no later than 10 June 2020). As a consequence of this, if an employee has been working on reduced hours throughout the pandemic and has never previously been furloughed, they will not be eligible for flexible furlough from 1 July 2020.

Under the furloguh extension from 1 November:

Under the current guidance, there appears to be no objection to furloughing employees who have agreed to reduce hours/pay.

Q14: *UPDATED* What is the position of employees who are serving notice of termination?

From 1 December 2020, employers are unable to claim under the furlough scheme for employees who are serving a contractual or statutory notice period.

There appears to be no barrier in the current guidance to an employer rescinding notice given and furloughing employees, with a view to reassessing their position when the scheme ends. Employers should carefully consider the impact such continuing employment might have on liabilities to pay redundancy payments when the scheme ends (if the employee in question passes the 2-years’ service threshold during their time on furlough) or on collective consultation obligations (the process may need to be re-run if notices are rescinded).

Q15: What is the position of employees who are contracted to join us but have not done so?

The scheme only covers employees who were “on the payroll” on 30 October 2020 (note: previously this was 19 March 2020 and 28 February 2020 under the furlough scheme prior to the November extension). This means that a payroll record has been set up and submitted under HMRC’s real time information (RTI) system for that employee between 20 March and 30 October 2020. If no PAYE RTI submission was made in this period, the employee will not be eligible under the CJRS.

Q16: Can an employee who is furloughed return to work and be furloughed again?

Yes.

Until 30 June 2020, there was a minimum furlough period of 3 consecutive weeks. This means that any employee who begins an additional period of furlough after returning to work on or before 30 June must complete a full 3 consecutive weeks of furlough before they can return to work or be moved to flexible furlough. For example, if an employee returned to furlough on 22 June, they must remain on furlough until at least 12 July in order for the period from 22 June to 12 July to be recoverable under the CJRS. After 12 July, the employee can return to work and/or move to flexible furlough.

From 1 July 2020 to 31 October 2020, this 3-week minimum was removed and furlough periods can be any length of time. However, the minimum claim period is 7 calendar days.

For the furlough extension from 1 November the position remains as from July to October: furlough periods can be any length of time, but the minimum claim period remains 7 calendar days.

Q17: Are directors eligible?

Executive directors (i.e. those with an employment contract) are eligible. Non-executive directors are also eligible if they are remunerated by PAYE.

The guidance was updated on 1 May 2020 to make it clear that directors who are paid annually, not just periodically during a year, are also eligible (provided they meet the other criteria).

Furloughed directors can carry out duties to fulfil statutory obligations so long as they do no more than would be judged reasonably necessary for those purposes. Directors should be careful not to overstep this limit or this could prejudice a grant application. The new Treasury rules, which will now bind the HMRC, state that statutory obligations for these purposes mean work undertaken by a director to fulfil a duty or other obligation arising by or under legislation relating to (1) the filing of company accounts, or (2) the provision of other information relating to the administration of the company.

Finally, it is worth noting that the scheme rules state that any furlough arrangements applying to directors must be adopted formally as a decision of the company (presumably, by a board resolution).

Q18: Are partners eligible?

Most partners and LLP members are self-employed and so will be outside the scope of the scheme.

However, members of LLPs who are designated as employees for tax purposes (“salaried members”) are eligible to be furloughed although amendment of the LLP agreement may be required.

The government announced on 26 March 2020 a scheme for the self-employed, but this only applies to those with profits of less than £50,000. We are not covering the detail of this scheme in our FAQs, but more information can be found here.

Finally, it is worth noting that the scheme rules state that any furlough arrangements applying to LLP members must be adopted formally as a decision of the LLP (presumably, by a resolution).

Q19: Are zero hours employees and agency workers eligible?

Yes (assuming that they are paid through PAYE).

Q20: *UPDATED* Can employees who are currently absent on sick leave (including those self-isolating in accordance with government advice) instead be furloughed?

Employees can move between sick leave and furlough leave by agreement, provided employers are not doing so to abuse the system.

Employees will also be able to be placed on furlough if their health has been negatively affected by COVID-19 (or another illness) and they are unable to work from home or need to work reduced hours. This includes those unable to work from home or who need to work reduced hours because they are clinically extremely vulnerable or at the highest risk of severe illness from COVID-19 or have COVID-related caring commitments (see below Q21). Employers should always carefully consider their discrimination risk when deciding to furlough employees within these categories.

Remember that the SSP has been modified so that with effect from 13 March 2020 employees can claim from their first day of incapacity and with effect from 14 March 2020 employers with less than 250 employees can reclaim SSP paid in respect of the first 14 days of COVID-19-related sickness absence.

Employers can reclaim the costs of up to two weeks of SSP for COVID-19 related absence under the Coronavirus Statutory Sick Pay Rebate Scheme. Needless to say, an employer cannot claim back payments to an employee under both the SSP rebate scheme and the CJRS in respect of the same period.

Q21: *UPDATED* Can employees who are at home looking after children or others be furloughed?

Yes. Guidance is clear that those with caring responsibilities arising from COVID-19 can be furloughed.

Q22: Do employers have to follow a redundancy or any other process before designating employees as furloughed workers?

There is no mandatory process. Employers will wish to ensure there is a clear business rationale for decisions about who to furlough in order to avoid allegations of discrimination and further arguments around the unfairness of any subsequent redundancies. This is especially important where there are a number of employees carrying out a similar role and only some of those employees are to be furloughed.

Informal consultation in a manner appropriate to the business in question is always good practice.

Q23: *UPDATED* What about sponsored workers?

The scheme rules state that “you can furlough employees on all categories of visa”.

The Home Office has now confirmed (in a separate statement) that the scheme can be used for sponsored migrants. They have to meet the same payroll date eligibility requirements as other employees (see above Q12). Some sponsored workers – especially some Tier 2 (Intra-company Transfer) migrants – will not qualify because they are not on PAYE.

It has also been clarified that sponsors can temporarily reduce the salaries of sponsored migrant workers to 80% of their salary or £2,500 per month, whichever is the lower. Any reductions must be part of a company-wide policy to avoid redundancies and in which all workers are treated the same. Pay must be returned to normal once these arrangements have ended. Sponsors must report on the SMS that a worker has been furloughed and report the reduction in salary.

Specific advice should be taken and Vanessa Ganguin, our immigration lawyer who can help answer any specific questions.

Q24: Does an employer’s decision to furlough trigger collective consultation obligations?

No, not in relation to the decision to furlough but collective consultation may still be required if redundancies are proposed, even if they will not take effect until the end of the furlough period.

Where an employer goes beyond contemplating the possibility of redundancies, to making a proposal to dismiss as redundant 20 or more employees at any establishment within a 90-day period then collective consultation obligations are triggered. Such consultation must begin in good time and for a minimum period of 30 days (45 if more than 100 redundancies are contemplated). This requires consultation with any recognised trade union or, if no other appropriate representatives, employee representatives who are elected for this purpose.

For these purposes, proposing to “dismiss” an employee is deemed to include a situation where the employee proposes to dismiss them under their current contract of employment and offer them new employment on a different (less costly) contract.

Many employers who do not wish to top up salary to 100% of pay will require employee consent to agree to the reduction in pay. They will use the risk of redundancy as the negotiating hook with which to seek consent. Here it will be important to be careful not to inadvertently trigger the collective consultation obligations by suggesting that there is a firm proposal to make redundancies.

Even if collective consultation obligations are triggered failure to consult awards can only be made to those who are actually dismissed. If the expectation is that every employee will consent to be furloughed now rather than to be made redundant after a minimum 30/45-day consultation period, then there will be no person able to bring a claim.

In many cases it will be sensible for employers to start collective consultation. This is so that they can be in a position to implement any necessary redundancies once the scheme comes to a close and so they do not need to wait a further 30/45 days.

This part of employment law can be tricky, so it is one area to check with an adviser if you are considering how to deal with a workforce of 20 or more potentially affected individuals.

Q25: Can employers carry out redundancy consultation whilst employees are furloughed?

This is not explicitly addressed by the guidance. In our view being consulted is not “work” and there some support for that view in the guidance so this should be permitted. However, there is a risk that HMRC adopts a different position after the fact.

This is significant because employers may want to get into a position where they can implement redundancies if things don’t improve once the government grant comes to an end.

Just to recap:

- Individual redundancy consultation – is required in all cases, where employees have acquired two years continuous service.

- Collective redundancy consultation -is required in all cases where an employer proposes to dismiss as redundant 20 or more employees at any one establishment in a 90-day period.

Union representatives and employee representatives have the right to paid time off for carrying out their duties and it may be necessary to “top up” their salaries for those days that they are carrying out their duties. There is also a greater risk that performing these duties is considered to be “work” and so that a claim for furlough payments in respect of any such employees might be rejected by HMRC.

Q26: Will being placed on furlough impact an employee’s a redundancy payment or a payment in lieu of notice (PILON)?

Taking each in turn:

- Statutory redundancy pay: From 31 July 2020 statutory redundancy pay must be calculated based on the employee’s normal (i.e. pre-furlough) rate of pay, not the reduced furlough pay.

- PILON: This will depend on the drafting of the furlough letter, but in most cases we would expect an employee terminated at the end of the furlough period will receive a PILON by reference to their normal salary. In some cases it may be possible for notice pay to be paid at a lower rate to take into account rates of furlough pay. This is a complex area and employers should take specific advice.

When seeking consent to reduce salary levels employers may wish to give comfort to employees that they will not be disadvantaged as a result of accepting a reduced salary although doing so may impact the tax treatment of any “top up” payments.

Q27: *UPDATED* Can we give notice of termination of employment now and furlough an employee for the duration of the scheme?

No. HMRC have confirmed that from 1 December 2020 a claim cannot be made under the furlough scheme for an employee who is serving a contractual or statutory notice period. This includes employees in their notice period prior to retirement or following their resignation. As a result, employees serving a notice period are entitled to full pay in the usual way, subject to any agreement with them to the contrary.

Q28: *UPDATED* How will the scheme be policed?

The grant is applied for with a simple “check box” declaration. It is expected thought that HMRC will have extensive enforcement powers to audit applications after the fact in order to prevent fraud and abuse. Successive iterations of the guidance and the Treasury Directions have placed increasing emphasis on the intention to police perceived abuse of the scheme.

There has of course been public criticism of perceived misuse of the furlough scheme by employers perceived to be able to afford staff fully.

A new self-policing mechanism was introduced into the furlough scheme on 12 June. This allows employers to declare that they have made an error in previous claim when they make a new claim on the online portal. If the error resulted in the employer overclaiming, this should be declared and the new claim will be reduced down to account for the overpayment.

The publication of employer details is also likely to be powerful self-policing mechanism (see Q41 below).

If the error resulted in an underpayment in a previous claim period, HMRC will need to be contacted directly as they will carry out additional checks.

Employers should keep records of any adjustments made to payments received under the CJRS for six years.

Q29: When will payments be made?

Payments to employers have started being made. Employers will need to pay and therefore fund salary costs in the meantime and may be eligible for a Coronavirus Business Interruption Loan.

Q30: *UPDATED* What paperwork do we need? What should we include in our furlough communication?

From 1 July 2020 (including the furlough extension from 1 November 2020)

When an employee is moved to flexible furlough, a new written agreement must be put in place (either an individual agreement or a collective agreement) before the first day of furlough. This should meet the following criteria:

- it should set out the new working patterns, covering the hours the employee will be working and the hours they will be furloughed;

- it sets out the main terms and conditions of the flexible furlough arrangement;

- it is incorporated (expressly or impliedly) in the employee’s contract;

- it is made in writing and agreed with the employee. It appears that, unlike the position until 1 July, the employee is required to respond to this written agreement. Employers should ensure they receive written confirmation of the employee’s agreement to the flexible furlough arrangement; and

- it is retained by the employer for at least five years (or the confirmation is retained until that date instead).

The furlough letter/agreement. This letter/agreement/email should be retained on file for at least five years. Topics to consider include:

- the revised working time during flexible furlough;

- whether there will be a reduction to basic salary whilst on furlough;

- when the furlough period will end and the employer’s right to require the employee to return to full time working;

- any impact on any benefits (life assurance etc) which are impacted by the change to salary;

- the duration of the current flexible furlough arrangements and ability of the employer to end the period of flexible furlough early; and

- the fact that employees should not work (perhaps otherwise than undertaking approved training, allowed voluntary activity, or checking emails for HR updates) during hours where they are furloughed.

The historic position up to and including 30 June 2020

Paperwork. To qualify for payments under the scheme, the employer needs an agreement with an employee (either an individual agreement or a collective agreement) which meets the following criteria:

- it states that the employee will cease all work in relation to his or her employment

- it sets out the main terms and conditions upon which the employee will cease working;

- it is incorporated (expressly or impliedly) in the employee’s contract;

- it is made in writing or confirmed in writing (including by email) by the employer; and

- it is retained by the employer until at least 30 June 2025 (or the confirmation is retained until that date instead).

The furlough letter/agreement. This letter/agreement/email should be retained on file until 30 June 2025. Topics to consider include:

- whether there will be a reduction to basic salary whilst on furlough;

- when the furlough period will end and the employer’s right to require the employee to return to work early;

- any impact on any benefits (life assurance etc) which are impacted by the change to salary;

- duration of furlough and ability of the employer to end furlough leave early; and

- the fact that employees should not work (perhaps otherwise than undertaking approved training, allowed voluntary activity, or checking emails for HR updates).

Employers may also wish to encourage employees to undertake training and to consider undertaking volunteer work in support of the wider community.

Q31: Are there any record-keeping obligations?

Yes. Furlough records including the furlough letters (i.e. designating employees as furloughed) must be kept for at least five years.

Note that the furlough period starts form the date that employees ceased working rather than date of the furlough letter and so if furlough letters have not yet been issued then they should be issued as soon as possible.

Employers should also keep records of the following for at least six years:

- The amount claimed in each claim period for each employee.

- The calculations used to determine the amount to claim, in case HMRC need further information about the claim (or audit the claim in the future).

- Any adjustments made to payments received from the government under the CJRS (see above, Q28).

If an employee is flexibly furloughed, the employer needs to comply with additional record keeping requirements (such records should be retained for at least six years), including:

- the usual hours worked for each claim period and the calculations used to determine this figure;

- the actual hours worked for each claim period

- the hours spent on furlough for each claim period.

These records must be kept for at least six years.

Q32: Payroll Mechanics – are there any other practicalities to be aware of?

We understand that the scheme will only pay out to businesses that have a UK bank account and were registered with HMRC’s online RTI PAYE system in respect of a furloughed employee, on or before 19 March 2020. The CJRS online portal commenced operation on 20 April 2020.

Employers should be prepared to complete declarations that furloughed workers have not been working in periods of furlough (we expect a revised declaration will be implemented from 1 July 2020 to reflect the introduction of flexible furlough). This will be easy for some employers but less easy for employees who can operate remotely. Employers will wish to ensure that the “no work” rules are understood by line management and appropriately policed.

An issue has arisen in respect of furlough periods that last for longer than 3 weeks, in terms of when the employer is allowed to seek payment from the government under the scheme. It is now clear that an initial furlough period can be extended by the employer even if the extension in itself is not for 3 weeks or more. However, the question is how this relates to the mechanism for claiming a payment for the government. For example, if an employee is furloughed for 5 weeks, does the employer have to wait and claim for the full 5 weeks in one submission, or can the claim be split into two submissions of, for example, 3 weeks and 2 weeks? The guidance is not clear on this; it just says each furlough period has to be at least 3 weeks long.

We checked with an adviser at HMRC who has told us in a webchat that two submissions can be made, even though the second submission in our example would only be for two weeks, instead of three weeks, provided the overall furlough period itself is longer than three weeks. We are unable to verify this further ourselves, but passing on the information we have received from the HMRC adviser. It may be desirable to make one submission per furlough period but if you do need to split the submission then make sure you raise this with your payroll provider who may want to clear it with HMRC first.

As the revised CJRS is introduced from 1 July 2020, the existing scheme gradually will be retired. This means that claims under the old scheme (i.e. for periods up to and including 30 June 2020) must be made by 31 July 2020.

From 1 July 2020 a number of practical changes are being made to the claim system, including:

- Claims periods must start and end in the same calendar month. If a period of furlough crosses the end of a month, separate claims must be made for the days falling in each month. This includes claims for periods that span the end of June into July – if an employee is on furlough for three weeks from 22 June to 12 July, two claims will need to be made covering (i) 22-30 June and (ii) 1-12 July.

- Claim periods must be a minimum of seven calendar days (unless the period you are claiming for includes either the first or last day of the calendar month, and you have already claimed for the period ending immediately before it).

Q33: Are nannies and other domestic workers eligible?

Yes, provided that they are paid through PAYE.

Q34: *UPDATED* What about employees who transferred into our business because of TUPE, after 28 February 2020?

TUPE transfers on or after 1 September 2020

These employees will be eligible under the furlough scheme, provided that:

- their employment transferred to the new employer n or after 1 September 2020;

- they were employed by either the new or the old employer on 30 October 2020;

- a PAYE RTI submission was made to HMRC by either the new or the old employer, notifying HMRC of a payment of earnings to the employee, between 20 March 2020 and 30 October 2020.

TUPE transfers on or before 10 June 2020

These employees will be covered, provided that the new employer has submitted a claim for the employees in relation to a furlough period of at least 3 consecutive weeks taking place any time between 1 March 2020 and 30 June.

TUPE transfers after 10 June 2020

These employees will be covered provided that:

- the TUPE or PAYE business succession rules apply to the change in ownership; and

- the employees being claimed for have previously had a claim submitted for them by their prior employer in relation to a furlough period of at least 3 consecutive weeks taking place any time between 1 March 2020 and 30 June.

For TUPE transfers effective after 10 June 2020, the maximum number of employees that the new employer can claim for under the CJRS is the total of:

- the maximum number of employees the new employer claimed for in any one claim ending on or before 30 June; and

- the number of employees that are being transferred to the new employer which have had a claim submitted for them in relation to a furlough period of at least 3 consecutive weeks taking place any time between 1 March 2020 and 30 June 2020.

Q35: What about employees who are on unpaid leave?

Employees on unpaid leave cannot be furloughed for the purposes of the CJRS scheme until their period of unpaid leave naturally comes to an end (in other words, any agreement between the employee and employer to cut short the period of unpaid leave will not be effective.

This is subject to an exception for any employee who started unpaid leave before 1 March 2020 and who agreed with the employer before 20 March 2020 to cut short the period of unpaid leave and be placed on furlough instead. A claim can be made in relation to such an employee.

If an employee was on unpaid leave before 28 February 2020, the employer needs to wait for them to come back to work according to their previously agreed schedule, before furloughing them. The relevant salary for furlough reasons will be 80% of their salary had they been on paid leave instead of unpaid leave.

If an employee was placed on unpaid leave after 28 February 2020, they can be furloughed instead.

Q36: Are there any implications for employers who operate share incentive plans?

This is not covered in the government’s furlough scheme at all, but we have included a FAQ as we are being asked this by clients.

EMI options are the most tax-advantaged – and therefore the most popular – of all UK employee share incentives but the favourable tax treatment ceases if a “disqualifying event” occurs in relation to an EMI option. One such event is if the holder of the option ceases to be required to work for his employer for at least 25 hours per week or, if less, 75 per cent of his total working time. If option holders are furloughed, they will obviously fail to meet this requirement during the furlough period.

There can be no real doubt that the Government will not want the tax status of furloughed employees to be tarnished as a result of having been furloughed. HMRC are aware of the problem and are promising to issue “guidance” in the very near future. While this guidance will no doubt be intended to be helpful to taxpayers, until we have read it we will not know what solution to the problem is to be adopted and whether that solution will be completely comprehensive.

We also understand that valuations agreed with HMRC for the grant of EMI options which until now have been valid for 90 days (increased last year from 60 days) will now be valid for 120 days. This is subject to the usual caveat if there are material developments affecting the company’s value.

There should be no significant implications for share plans other than EMI.

Q37: What about employees with salary sacrifice arrangements?

An employee who has reduced his or her base salary as part of a salary-sacrifice arrangement, will have their furlough payments calculated by reference to 80% of their new base salary, not their “notional” or “reference” salary (up to the monthly cap of £2,500).

The HMRC guidance states that HMRC will consider Covid-19 as a “life event” allowing an existing salary-sacrifice arrangement to be changed, without upsetting the tax treatment of a prior arrangement.

However, employees who have a salary sacrifice arrangement “reversed” and whose base salary increases as a result of this, should still have their CJRS grant amount determined by reference to the normal timing rules (see above, Q3).

Q38: Can employees who have stopped working insist on being rehired and placed on furlough?

There is nothing in the guidance or any law that would require an employer to reinstate someone in this situation if the employer did not want to do so.

However, it may be possible for an employee who is let go to bring an unfair dismissal claim against their ex-employer (assuming they have enough service to bring such a claim) and in the process of doing that argue that the dismissal was “unfair” because the employer could have furloughed them instead.

We do not yet know what an Employment Tribunal judge would say about this type of argument. Our current view is that it is not an attractive argument for an employee to make, but it is impossible to know at this stage.

Q39: *UPDATED* What is the market doing?

There has been a significant uptake of the scheme. HMRC data as at 11 June 2020, which you can see here, shows that 81% of all businesses have accessed the furlough scheme to date. It remains to be seen how the market responds to flexible furlough and the tapering of government subsidy from 1 August. It is likely that many businesses will restart any discussions about redundancies.

One issue to be aware of is the potential public relations aspect of accessing the scheme. A number of (well resourced) football clubs were criticised for furloughing staff and subsequently decided to reverse those decisions, as a result of adverse coverage. In other markets, some journalists are also now questioning whether large businesses with well-paid executives, should be accessing public funds to pay furloughed staff. Businesses that furlough and claim government payment should therefore expect their operations to be open to public/press/parliamentary scrutiny.

Q40: Is the Government encouraging job retention after the CJRS ends?

On 5 November the Government axed its Job Retention Scheme which was set to pay employers a £1,000 bonus in February 2021 for each employee who has been placed on furlough and who they retain in employment until the end of January 2021.

This is no longer being offered to employers as the extension of the furlough scheme until April 2021 will keep people employed past January.

Q41: *NEW* Does HMRC publish details of employers claiming under the furlough scheme?

Yes. HMRC will shortly begin to publish information of employers who claim under the furlough scheme for periods from 1 December 2020.

On 26 January 2021, HMRC will publish a list of employer names. In February HMRC will begin to publish the employer name, their company registration number (if relevant), and the amount claimed within a set of bands (ranging from £1 to £10,000 to £100,000,001 and above).

HMRC will not publish information about employers where it believes there is a serious risk of violence or intimidation towards individuals that may arise from such publication. Employers are able to contact HMRC to ask for information to be withheld. Full guidance is available from the UK Government here.

This information provided is for general information purposes only. The information presented is not legal advice and should not be used as a substitute for taking legal advice in any specific situation. Although this information summarises some major recent developments, it is not all inclusive and it may be subject to change as circumstances develop.